Not the sexiest subject, granted, but a seriously important one if you want to know how much you're going to have to live on when you stop work.

It's a decent top-up if you have other pensions, and a life saver if you don't.

Sadly, though, there's no flexibility over WHEN you can lay your hands on State pension. So if you've lost your job because of Covid or you have to stop doing paid work for other reasons, you'll have to claim benefits or find money some other way until you reach the magic age.

First things, first, though... how much will you get?

The easy answer is £175.20 a week. That's the theoretical amount for someone who has at least 35 FULL years of QUALIFYING National Insurance (NI) contributions. And it's for you personally, so your partner or spouse will get a State pension too.

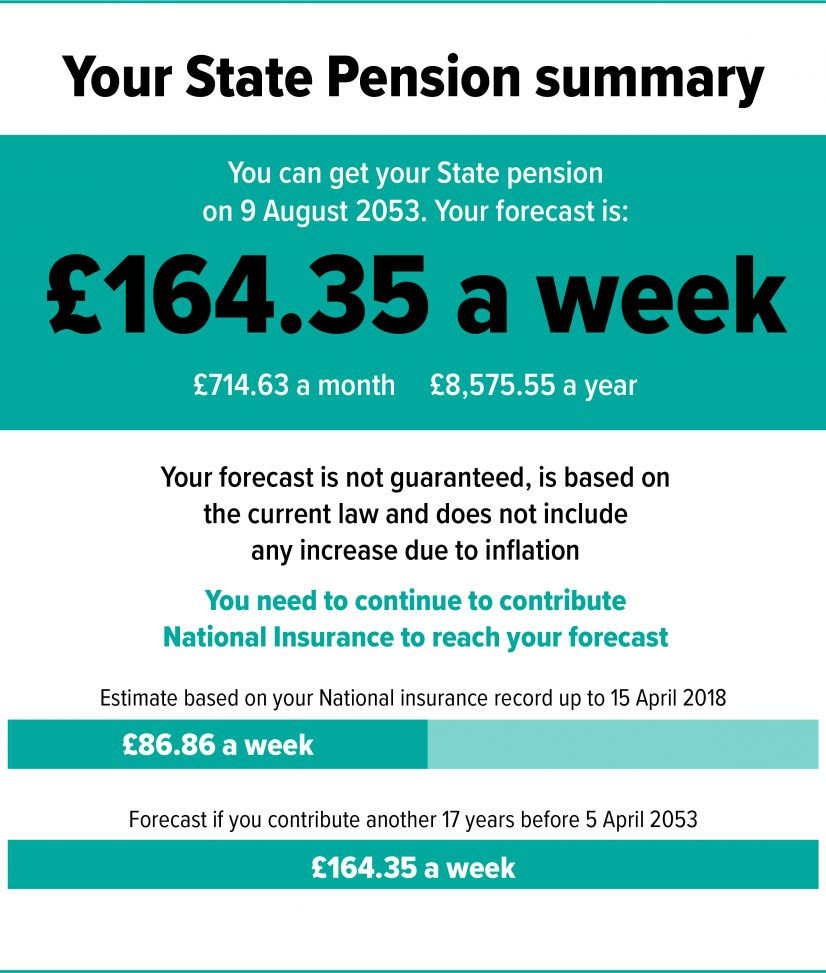

There's only one sure way to find out how much you'll get in practice, which is to get an official forecast. That's easy to do online if you're already registered on the government Gateway, a bit more cumbersome if not. Here's the link: https://www.gov.uk/check-state-pension. This will provide four crucial pieces of information:

- When you'll get your State pension (which won't be until you're 66 or even a bit older)

- How much you've already built up

- How much it'll be if you keep paying NI until your State pension age

- If there are any 'missing' years in your NI record that you can buy back

The last is important, especially if you only missed the odd week or two in an NI year, because it may be a very cheap way of buying extra income for life.

So how do they get to the numbers?

'Full years' means that even one week of missing stamps means the year doesn't count (yes, I'm old enough to remember when NI stamps were physically stuck onto a card).

'Qualifying' is a nasty little twist affecting some self-employed people who may have paid NI for years, but not the cheap and voluntary Class 2 version that counts toward State pension.

You get nothing if you have fewer than 10 qualifying years, but you get credits for any time you were receiving Child Benefit or Carer's Allowance, or were registered unemployed. (That's one of the reasons it may be worth applying for Universal Credit if you've recently lost your job).

Add up the years, to a maximum of 35, and the basic amount you'll get is about £5 a week per year of credits.

That's not the whole story, though, as there are more adjustments related to something called contracting-out. This is far too complicated to go into here, but it basically means you'll get a bit more or a bit less State pension depending what kind of workplace scheme you were in or if you opted out of the old earnings-related State scheme.

It's very easy to claim when the time comes. Provided the government knows where you live (!), they'll write to you a couple of months beforehand to say how much it's going to be and how to claim. Otherwise, go online - here's another link: https://www.gov.uk/new-state-pension/how-to-claim.

You won't get the money if you don't claim (occasionally huge back payments are made to people in their 80s and 90s who didn't realise they've been missing out). But you can also deliberately delay, if it suits your finances, and get a bigger pension later.

These days, the money is paid into your bank so there's no more queuing at the Post Office on Thursdays to pick it up in cash. That's just as well as the nearest Post Office is probably miles away... though some old folk are still nostalgic for the weekly chats while waiting.

Overall, the State pension really is a wonderful thing.

It's as certain as anything in these very uncertain times. It's taxed like any other income but always paid in full, with any tax due recouped later. And - at least for now - it's fully protected against inflation. (I'm still scarred by the memory of 25% inflation when I started working life. Imagine what that would do to the buying power of a pension that stayed at the same level in £p year after year...)

So look forward to the day when, after a virtuous and hard working, tax-paying life, you can get something back from the government. And aim to enjoy it for as long as you can!

ความคิดเห็น